Poll Results: Life Insurance for CPA Firm Partners

![]() Kristen Rampe, CPA / Feb 12, 2023

Kristen Rampe, CPA / Feb 12, 2023

We polled our audience of partners to find out the approximate average value of the life insurance policy (where the firm is a beneficiary) that they held on equity owners, at the date the policy was purchased.

Many, but far from all, firms choose to hold life insurance on partners to assist with paying any retirement benefits owed, should a partner pass away unexpectedly. Other firms hold a smaller value policy as a benefit similar to what employees have, and buyouts are left more at risk except for the occasional firm that has other buyout funding methods.

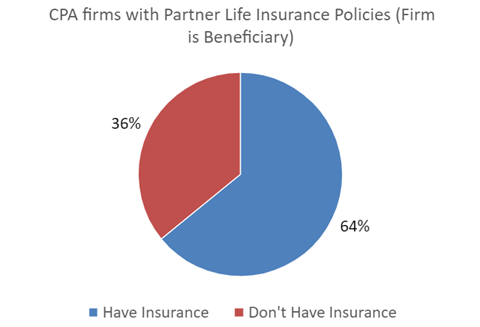

Based on 117 responses, we learned that 36% did not hold life insurance on partners with the firm as beneficiary.

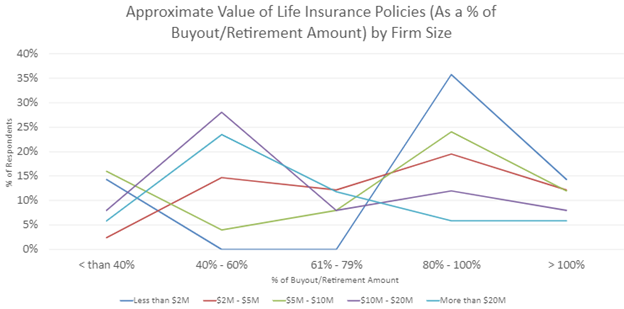

Of the 75 firms that did have life insurance with the firm as the beneficiary, 31% held a policy with a value that was 80%–100% of the partner’s buyout/retirement amount, and another 24% held a policy with a value of 40%–60% of the partner’s buyout amount at the time of policy purchase.

Results of the poll by firm size:

We also received comments from firms regarding their life insurance policies. Some perspectives of note are included below.

Regarding the amount of life insurance held on partners:

- “Life insurance amounts are probably 50% of the buyout amount in general. They may be coincidentally 100% of buyout for a new owner, but the % reduces over time as the buyout increases.”

- “Meant to cover the retirement/buyout and allow the firm to spend funds necessary to replace a partner.”

- “Buyout value has continued to grow, yet life insurance policy has not been adjusted.”

- “We maintain $300,000 policies on our shareholders, so that varies greatly as to the % of his/her buyout. It is evaluated every few years, but no changes have been made to the level.” ($10M–$20M firm)

- “We carry an insurance benefit of $1 million on each partner. A couple of partner buyouts are slightly higher than that.” ($2M–$5M firm)

- “It’s a balance between appropriate amount of projected buyout, age of partner vs potential level of insurability at end of term of the policy, versus cost of insurance, particularly as we grow as a partner group.”

Why not have insurance?

- “Buyout is fully funded with other liquid assets.”

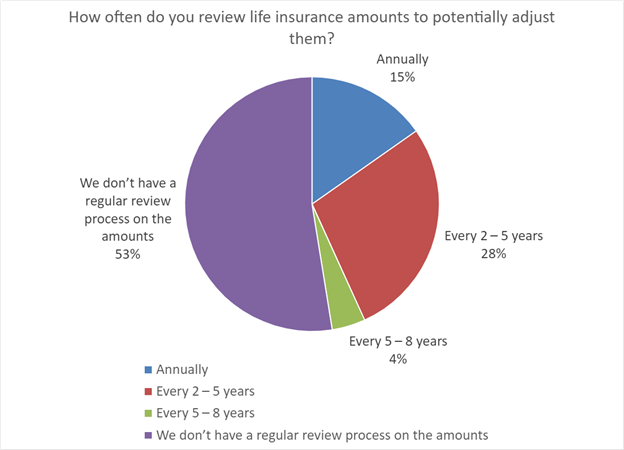

Regarding review cycles of coverage amounts:

- “We review coverage periodically, but it is relatively difficult to adjust the coverage and get new policies. We may keep coverage for a year or two after stock redemption or until the premiums increase rapidly.”

- “We performed a review at the request of a new partner about 10 years ago. We agreed that a fixed amount was acceptable”

Other policy aspects:

- “We have started to carry a whole life or variable life product on our younger partners, so that their buyout will be about 80% funded at retirement.”

- “We have used policies with cash surrender value on younger partners to take out a loan to pay capital when older partners retire.”

- “Partners own the policies individually on the other partners’ lives, but the partnership pays the premiums and they are treated as non-deductible expenses shared on the ratio of ownership.”

What is your firm’s practice regarding life insurance for partners? Do you feel you need it? Would your firm suffer financially if a key partner passed away with no warning and was due a significant buyout? On the flip side, it can be difficult—and costly—to obtain insurance on more mature partners. We’d love to hear how you approach life insurance at your firm in the comments below.

CPA Firm Partner Retirement / Buyout Plans

The guide to creating a well-written, competitive buyout agreement: the industry's first-ever detailed reference source - an invaluable tool for firms drafting an initial plan or revising and updating an existing agreement.

Learn More