Poll Results: When Do You Pay Partner Retirement Benefits?

![]() Kristen Rampe, CPA / Sep 23, 2022

Kristen Rampe, CPA / Sep 23, 2022

Partner contributions to a firm are typically rewarded in both handsome compensation currently, as well as a buyout or deferred compensation upon retirement. What better way to reflect the value that an individual has created in your business over decades of commitment?

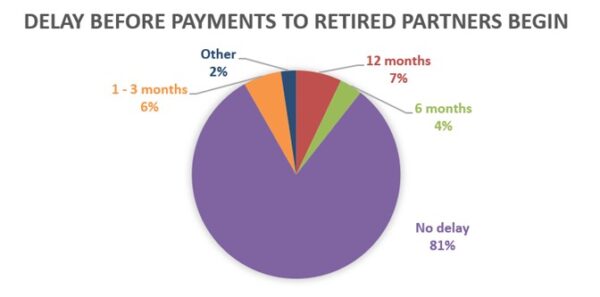

When partners retire, amounts owed need to be calculated and paid. The calculation is often determined well in advance, and payments follow quickly. We came across a client recently whose payments to retired partners were delayed by 18 months. This seemed unusual, maybe with an exception for non-retirement withdrawals, like expulsion for cause. (We’re a pretty tame group – but there’s occasionally a rogue accountant who thinks misappropriation of assets isn’t a problem.)

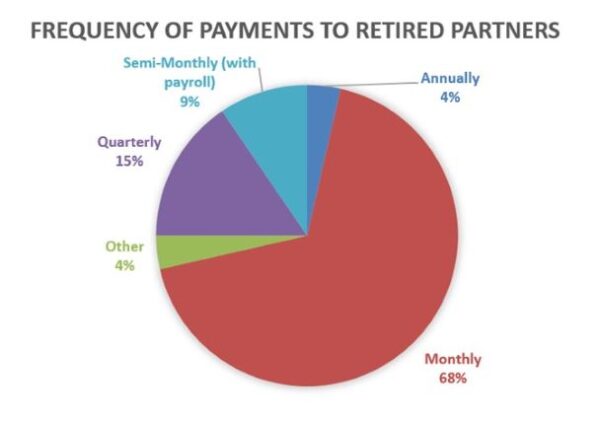

We polled our audience of partners to find out what CPA firms are doing when it comes to paying retired equity partners or shareholders. Here are the results based on 85 responses:

Other responses:

- One responded weekly.

- Two responded that they pay half of the amount on a monthly basis, and the other half annually based on the cash flows of the firm (e.g. after tax season collections).

CPA Firm Partner Retirement / Buyout Plans is a must-read for firms that need to update their existing plans or write a new agreement. The book addresses ►what CPA firms are worth ►what partners must do to get their buyout money ►how to value a firm’s goodwill ►the acid test of a well-conceived retirement plan ►6 methods of determining an individual partner’s buyout ►vesting ►notice and client transition requirements ►mandatory retirement ►non-compete and non-solicitation covenants

- No one in our poll had a delay longer than 12 months.

- Two responded in “Other” that they delay until the beginning of the next calendar year to avoid self-employment tax issues.

Noteworthy comments:

- “An estimate is paid starting within 30 days, and then there is a true up as soon as the actual is determined later in the year following retirement.”

- “I think we would pay monthly, except that with an April year end, we don’t really have the big cash collections until after 4/30, so we hold off and pay the other one-half after our year end, when our cash position is strong.”

- “Partners cannot start collecting until age 60, even if they retire before that age.”

- “Delay is due to distribution of capital during the first 12 months of retirement.” (They reported a 12-month delay.)

If you’re nearing retirement, does your firm have a reasonable plan for the timing of buyout payments? If not, it may be a discussion to tee up with your partner group.

1 Comments

CPA Firm Partner Retirement / Buyout Plans, 2nd Edition

New Second Edition! The guide to creating a well-written, competitive buyout agreement: the industry's first-ever detailed reference source - an invaluable tool for firms drafting an initial plan or revising and updating an existing agreement.

Learn More

Kristen – great poll. I like your comment that partners receive two forms of compensation: current and deferred. Like all compensation, deferred compensation should be EARNED, not an entitlement based on seniority or ownership percentage. Firms should ensure that the determination of the deferred comp for a retiring partner is based on what the partner did to contribute to building up the firm’s value and profitability.