The AAV Method Demystified

![]() Amanda Lilley, CPA, SHRM-CP, PHR / Apr 13, 2022

Amanda Lilley, CPA, SHRM-CP, PHR / Apr 13, 2022

You may be wondering why the Average Annual Value (AAV) method is a common method accounting firms use to determine each partner’s goodwill amount for retirement purposes. You may also be wondering what the AAV method is and how it works. Whichever camp you’re in, you’re not alone! Let me help you by demystifying answers to these exact questions.

What is the AAV method?

The AAV method is a computation firms use to determine each partner’s share in the goodwill value of the firm.

Goodwill is one of two values that factor into a retiring partner’s buyout amount; the other is their return of capital. (Any reference to partner within this context refers to equity partners only.) Return of capital is the easier to understand since it’s typically tracked by each partner’s capital balance or ownership percentage. The goodwill portion, on the other hand, is subject to ambiguity and confusion because it can be computed in many ways.

Most firms using an AAV system determine each partner’s relative share in the annual growth of the firm based on their relative share of total partner compensation.

How does the AAV method work?

Step 1:

A firm can adopt this method at any point, but must determine a beginning value. Options include:

- Ending balances from the old system they were using

- Book of business for each partner

- Relative income for each partner based on the prior year

- An equal amount for each partner

- Ownership percentage

CPA Firm Partner Retirement / Buyout Plans is a must-read for firms that need to update their existing plans or write a new agreement. The book addresses ►what CPA firms are worth ►what partners must do to get their buyout money ►how to value a firm’s goodwill ►the acid test of a well-conceived retirement plan ►6 methods of determining an individual partner’s buyout ►vesting ►notice and client transition requirements ►mandatory retirement ►non-compete and non-solicitation covenants

Step 2:

Once the beginning balances have been determined, it’s time to decide how to calculate the balances each year going forward. This requires knowing each partner’s share of overall partner compensation and total increase (or decrease) in total fees for that year. As an example, let’s use the following data for a $4M firm with four partners:

Partner Compensation for 20X1:

Partner 1 – $325,000 (26%)

Partner 2 – $275,000 (21%)

Partner 3 – $400,000 (31%)

Partner 4 – $280,000 (22%)

Total = $1,280,000 (100%)

Total increase in net fees (billings) for 20X1: $400,000

Step 3:

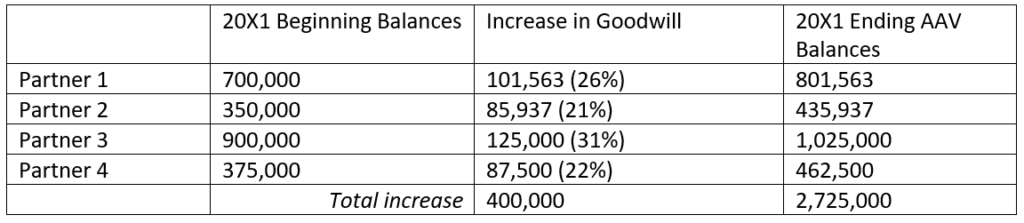

The next step is to determine each partner’s increase in goodwill by taking their share of total partner compensation and multiplying that by the increase in fees for that year. The increase in each partner’s income is shown below.

From here, the firm would keep computing increases each year and, subsequently, the ending balances.

Step 4:

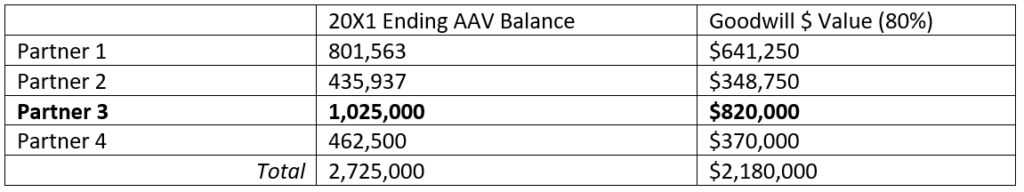

To compute a retiring partner’s total goodwill amount, the firm will need to determine how they want to set the overall goodwill valuation of the firm. Most often, CPA firms express this as a percentage of revenues, with 80–100% being common. For this example, I will assume Partner 3 is retiring and the firm values goodwill at 80%.

In this example, the ending balance gets discounted to 80%, resulting in the final dollar value of the goodwill amount. Partner 3’s return of capital, combined with the goodwill dollar amount, equals their total buyout amount.

Partner Buyouts and Compensation Systems

The AAV system is effective and fair only if a firm’s underlying compensation system is working well. Using a compensation system that doesn’t fairly reward partners for their contributions and value they add to the firm could skew this computation dramatically and result in retiring partners being over or underpaid.

1 Comments

CPA Firm Partner Retirement / Buyout Plans

The guide to creating a well-written, competitive buyout agreement: the industry's first-ever detailed reference source - an invaluable tool for firms drafting an initial plan or revising and updating an existing agreement.

Learn More

I suggest you look at public company EBITDA ratios to FMV. Unfortunately most CPA’s cannot calculate EBITDA because they have no credible means of determining comparable EBITDAs. Isn’t that redicalous!!